Feetpix and Free Mints: Is the Next Bull Market Around the Corner?

Coinbase Layoffs + Macro Update | Good & Bad NFT Launches | Lens Introduces Token Gating

Prefer listening? Get this week’s brain download through your favorite platform 👇

GM DOers!

It’s Saturday and that means it’s time for your weekly brain download of all the latest news in web3.

In this week’s Rollup, we’re breaking down:

- Coinbase’s layoffs and a look at the economy’s macro trends 🤔

- Free mints that are taking the NFT world by storm 😬

- Token gating on social media with Lens’ newest feature 🪙

- Web3 Person of the Month. Hint: He played a big role in launching Moonbirds 🐦

Before we dive in, though, we wanted to congratulate all the DOers that went PRO yesterday and joined the elite crowd in web3. 👏

To everyone else, we still love you guys but don’t forget that you have less than 24 hours to go PRO at a 50% lifetime discount!

Don’t get left behind.

Start 2023 on the right foot with the #1 resource that builders, investors, and creators use to stay at the forefront of web3. 🚀

Note: PRO will double in price tonight—no ifs, ands, or buts!

Now, let’s dive into the news.

WE’RE NOT OUT OF THE INFLATIONARY WOODS YET

Coinbase Cuts Another 950 Employees

Another round of layoffs has hit the popular exchange, bringing the total number of positions cut to more than 2,000 in the past year alone. 😬

This got us thinking about where we’re currently positioned from a macroeconomic perspective.

Some people may think crypto (and by proxy web3) is dying a thousand deaths, but the same situation is happening in web2 across many uncorrelated industries.

Even Amazon will soon be laying off 18,000 people! 🤷

Why? We live in a debt-driven economy based on “boom and bust” cycles.

In a perfect world, the Fed (and other government entities) would keep their economies growing at a consistent pace, but there are too many variables in play—which is why we have bull and bear markets.

In bull markets, businesses take out loans—because debt is cheap—and then use them to drive growth (boom) through hiring employees, marketing, product development, etc.

As more money enters the economy, the prices of goods increase, causing inflation to increase as well. The problem is that governments can’t let this growth happen too quickly so they start raising interest rates which makes debt more expensive and forces companies to cut costs (bust).

It’s difficult to estimate where we are in the current bust cycle, but numbers are starting to look a bit better.

Recent CPI numbers came in at 6.5 (down from 7.1) which is a significant positive for the economy, but that doesn’t mean we’re automatically back in a bull market.

The Fed won’t suddenly drop interest rates but if this trend continues, you can expect them to either slow down rate increases or potentially even start to slowly lower them—the key word being slow!

But no matter how scared you might be about the current economic outlook, the days of low-interest rates will come again (the US government itself has too much debt to keep rates high for an extended period).

And, even though you’re seeing layoffs happen, it doesn’t mean things are getting worse. Instead, we might be closer to the bottom than you think!

If these macro topics get your brain firing on all cylinders, Kyle is working on a Web3 Academy PRO report on the fundamentals of pricing crypto which is coming out very soon. 🔥

One particularly interesting chart that Kyle will share is the global M2 money supply which tracks the inflows and outflows of worldwide liquidity.

In his own words, “I’ve never seen a chart that is so correlated with crypto cycles.”

So ensure you don’t miss it by going PRO with a 50% lifetime discount—remember, you have less than 24 hours left!

Overall, the big takeaway here is that the whole world is experiencing this bear market together, not just crypto—and based on where prices are currently, we could certainly see some big moves (think 2x or 3x) before the bull market officially returns.

Make sure to look at the big picture, frens. 🖼️

🤝 Together with Unlock Protocol: NFT Ticketing is the Future. Learn How to Easily Create and Sell NFT Tickets for Your Next Event!⚡

BULL MARKET VIBES

Feetpix, Friendship Bracelets, and Free Mints

Although the overall macro picture is bearish, it seems like NFTs are bucking the trend with a mini bull run—particularly in free mint collections.

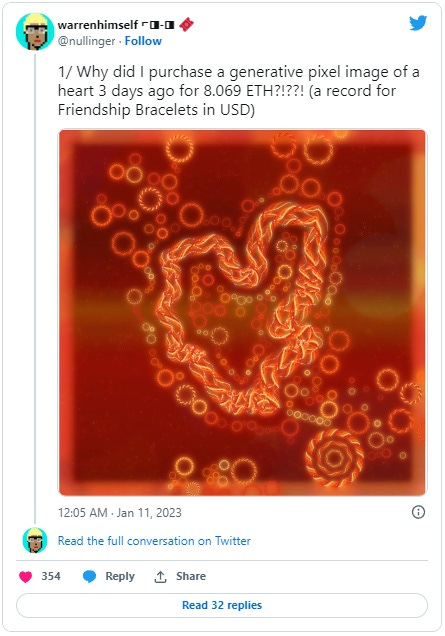

It all started with the Friendship Bracelet drop from Art Blocks, a leading generative art project.

You all likely remember having friendship bracelets as a kid, you know the matching bracelets where you keep one and give the other to your best friend, boyfriend, girlfriend, or another person close to you?

Well, this drop by Art Blocks had a similar purpose.

Holders of an Art Blocks NFT were able to mint two free bracelets with the project encouraging holders to share the second bracelet with someone outside of web3.

While the project didn’t mint out, there are just under 40k friendship bracelets in existence with a current floor price of 0.5 ETH.

We think that the success of this free mint comes down to its potential for becoming an iconic project later down the track.

First of all, Friendship Bracelets is all about the art (at least right now) so it automatically removes an expectation of making money, reducing the chance of holders being speculators.

Secondly, the project is all about connection. If someone gives you a Friendship Bracelet, there’s a low chance that you’ll sell it because of what it signifies.

On top of this, each NFT will come with instructions on how to create a physical edition of the friendship bracelet.

Combine these points with the fact that it’s a large collection with the potential to onboard thousands of new people into web3 and you have a recipe for increasing staying power and long-term success. 📈

But there’s another free-to-mint collection called Feetpix that’s been making waves recently, and not for the right reasons.

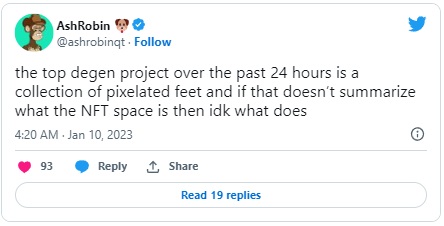

Just check out this tweet and you’ll know why.

Now, people could only get one free mint per wallet with each subsequent mint costing 0.002 ETH. However, the last 3,000 of the 10k collection were sold at 0.0039 ETH each—still basically free.

Since the 10k collection of pixelated feet launched speculators have been going crazy. In just a few days, the collection has done over 1,170 ETH in secondary volume making it the 5th most-traded project on OpenSea recently.

Right now, we’re 50/50 on whether this is good for the space or just another pump-and-dump scheme. 🤔

On one hand, we’ve seen this exact playbook before with projects like Goblin Town. GTown did eventually become a respected NFT project, but whether that’s because of its own merit or because Truth Labs doxxed themselves as the creator we don’t really know.

And on the other hand, we basically have this nothing collection that has been pumped by degens and their love of memes.

In fact, it could even be seen as a net negative for the space. Just imagine being a regulator or even an investor that wants to explore web3 and the Feetpix collection is the first thing they see. 💀

But the main determinant of whether this collection is seen as good or bad comes down to what happens next.

Since Feetpix is a CC0 (creative commons zero) project, will we have holders spin off their own projects? Will we see the team behind the collection consolidate and build with their community?

We don’t really know yet, but maybe Jay can create a mashup of his Moonbird with some Feetpix—Moonfeet anyone? 🤔

SOCIALS

Thread of the Week

GATE THOSE POSTS HOMIES

Lens Unveils New Token-Gating Feature

For those who don’t know, Lens is a decentralized social graph that allows users to own their content and followers as NFTs.

Not only does that allow us to move between platforms without losing our social identities, but it also gives us more control over how people interact with our content.

And their newest ecosystem-wide token-gating feature allows us to do just that across any dapps built on Lens. 🔥

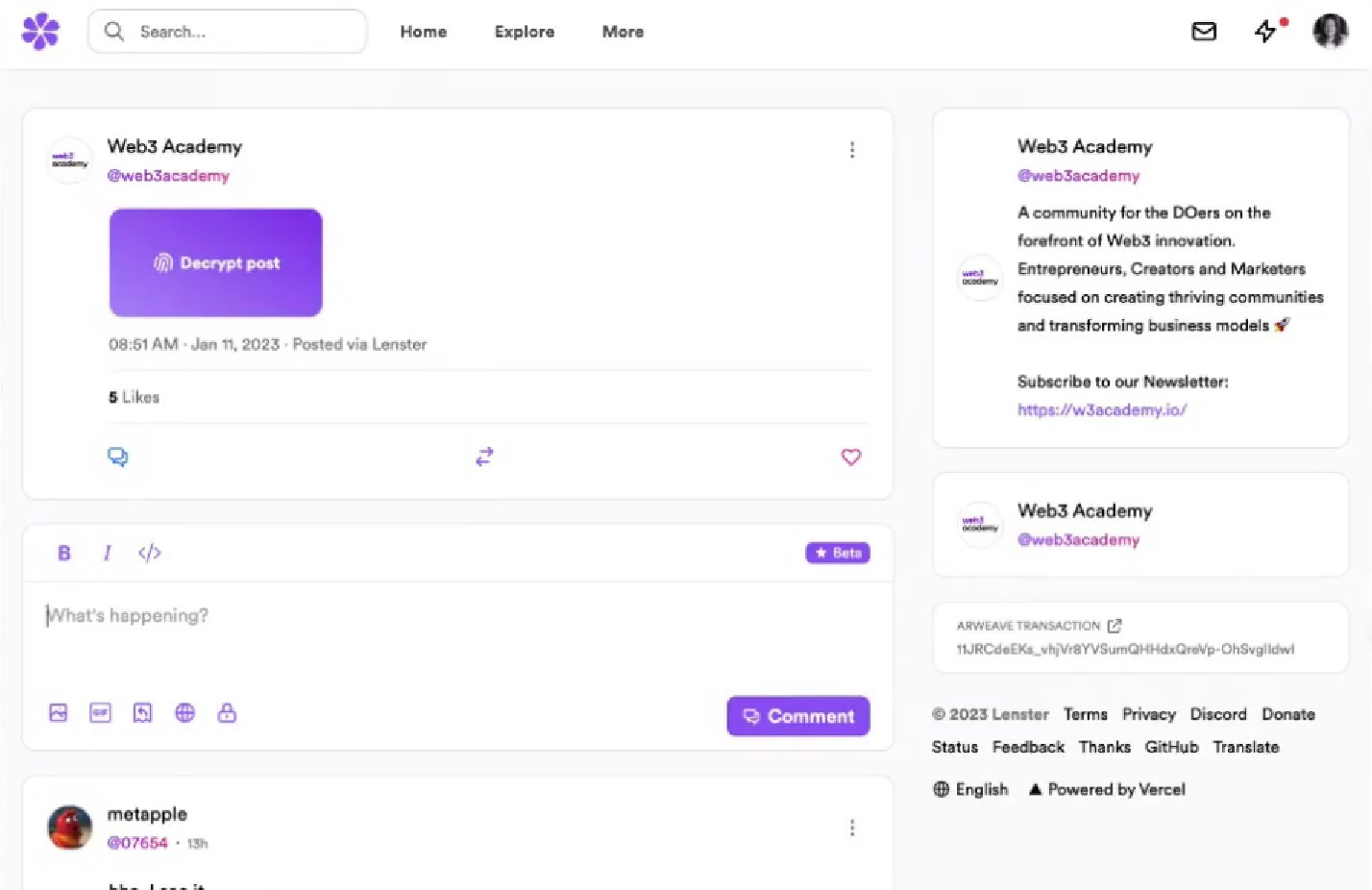

This allows you to only share certain pieces of content with certain followers. For example, here’s a token-gated post from Web3 Academy on Lenster.

As you can see the post is hidden by a purple block, so our followers first have to hit “Decrypt Post” before they can see it. This prompts an on-chain interaction where you’d have to sign a message before you can prove that you should have access.

What can you do with this feature?

- Paywall your whole account so people have to pay before they follow you

- Create quests where people have to complete actions to unlock content

- Paywall specific pieces of exclusive content

For example, if we had podcast NFTs, we could token gate pieces of content for people who’ve watched (or listened to) at least five episodes.

While this feature is an excellent and much-needed addition to the Lens ecosystem, its current UX needs some work—and so does the whole of web3!

But right off the bat, we’d love to see some more user-friendly copy. For example, many people won’t understand what “decrypt” means. Instead, simpler copy such as “unlock this post” would have been more effective.

We don’t say this to take a dig at Lens either (we love you guys!!), it’s more of a reminder to developers that they should remember to collaborate with their marketing teams! 😅

WEB3 PERSON OF THE MONTH

Ryan Carson: From Treehouse to Web3

This week’s Twitter poll was all about top web3 builders with Farokh, Ryan Carson, Jeff Kaufman Jr., and Erick (Snowfro) going head-to-head for ultimate bragging rights.

While the competition was tight, Ryan Carson ultimately ran away with the prize, capturing 68% of the votes—congrats Ryan! 🎉

So who is Ryan Carson?

Ryan is currently the host of the Daily Dose, a Twitter Spaces show covering the hottest news and trends in web3. 🔥

But he’s no stranger to building in the trenches either.

Ryan’s also the ex-COO of PROOF (the company behind Moonbirds which Ryan also helped launch). On top of this, he was the founder and CEO of web2 startup Treehouse, an online tech and programming school that has taught over 600,000 students. 😲

Thanks for all you’re doing to move the space forward Ryan, we’re excited to see what you do next!

NUMBERS TO KNOW

$25

That’s how little you can pay for a 2,000-person group Zoom call with Donald Trump. Source

$8,283

That’s the OpenSea ETH trading volume of Friendship Bracelets after minting less than a week ago. Source

$5,000,000,000,000

That’s how much value McKinsey estimates the metaverse will generate by 2030. Source

AROUND WEB3

Other Web3 News

- The Australian Open continues its web3 campaign with an NFT treasure hunt in Roblox. Source

- K-Pop girl group, Lightsum, teamed up with top fashion designer Victor Weinsanto to launch a metaverse fashion line. Source

- DressX partners with Dundas to drop a digital fashion collection on Roblox. Source

- Tribeca Festival, a popular cinematic event, launches VIP NFT passes. Source

- LG announces plans for a metaverse TV. Source

- OVR unveils its virtual headset prototype that allows users to experience smells in the metaverse. Source

- OWO showcases its second haptic product, OWO Sleeves, which allows users to experience physical sensations during digital experiences. Source

- Ava Labs, the company behind the Avalanche blockchain, announced a partnership with Amazon Web Services (AWS) to simplify tech deployment. Source

- Mastercard announces web3 accelerator for musicians. Source

- Highly anticipated Game of Thrones NFT collection disappoints holders. Source

- National Geographic goes web3 with NFT collection titled, GM: Daybreak Around the World. Source

- ETH Denver unveils Camp #BUIDL, a 10-day hackathon, in partnership with Chainlink. Source

- Sappy Seals launch an “AI Meme Machine” for NFT holders. Source

- Tech bloggers say Twitter is working on “Twitter Coins” and awards features. Source

- Cointelegraph launches web3 accelerator with a twist. Source

FOR THE DOERS

Take Action & Level Up

READ

Check out the last free Web3 Academy PRO report: Is Solana Following in ETH’s 2018 Footsteps?

JOIN

Don’t miss your chance to lock in a 50% lifetime discount on PRO—aless than 24 hours left!

LEARN

Take our FREE Web3 Rabbit Hole Course to get up-to-speed on the foundational components of Web3 so you can confidently build, work, or use the fastest-growing technology in history